Business Insurance in and around Saint Louis

Get your Saint Louis business covered, right here!

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Do you own a yogurt shop, a gift shop or a cosmetic store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on what matters most.

Get your Saint Louis business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

Your small business is unique and faces a different set of challenges. Whether you are growing a shoe repair shop or a pet store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Mike Heidger can help with worker's compensation for your employees as well as key employee insurance.

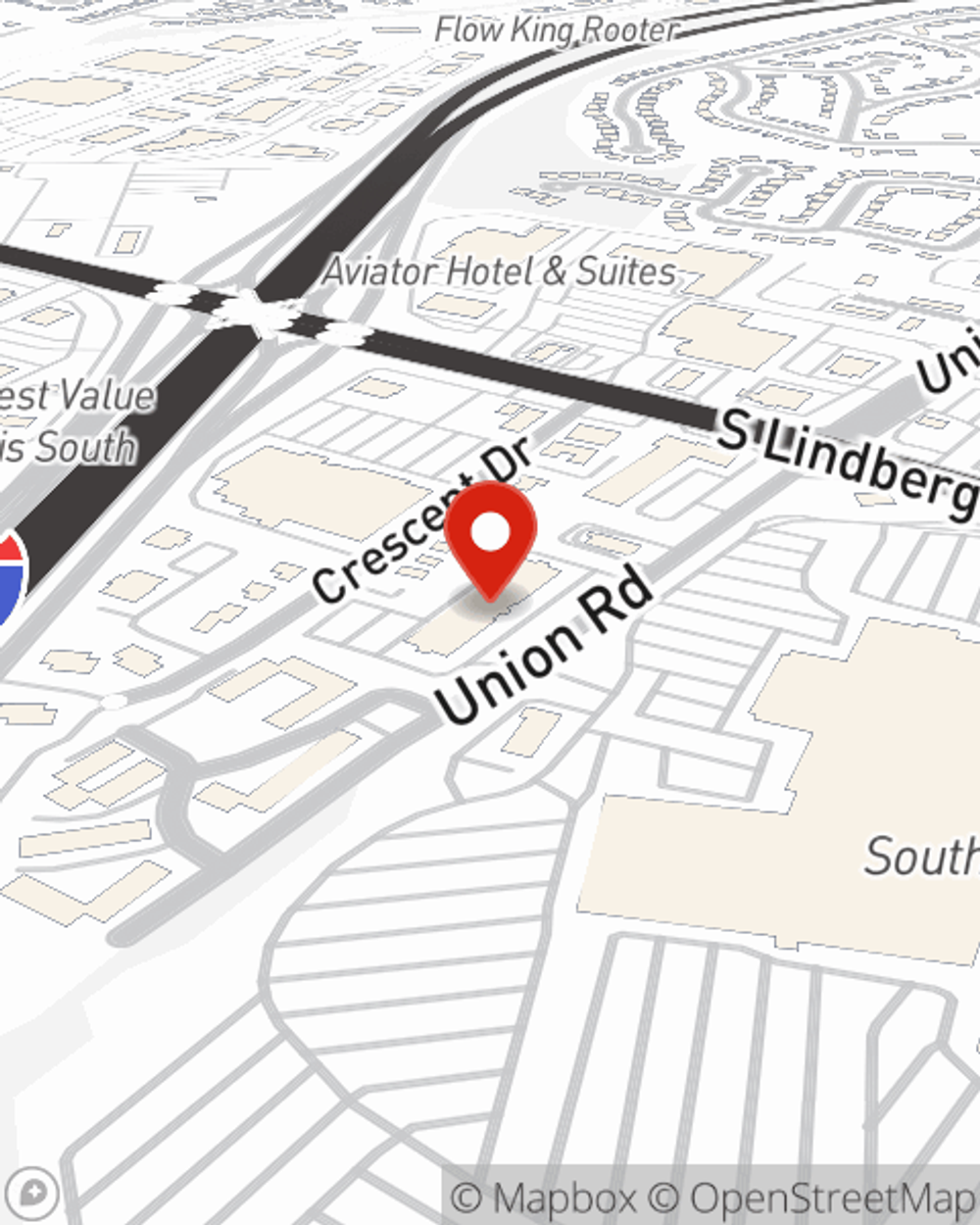

The right coverages can help keep your business safe. Consider visiting State Farm agent Mike Heidger's office today to identify your options and get started!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Mike Heidger

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.